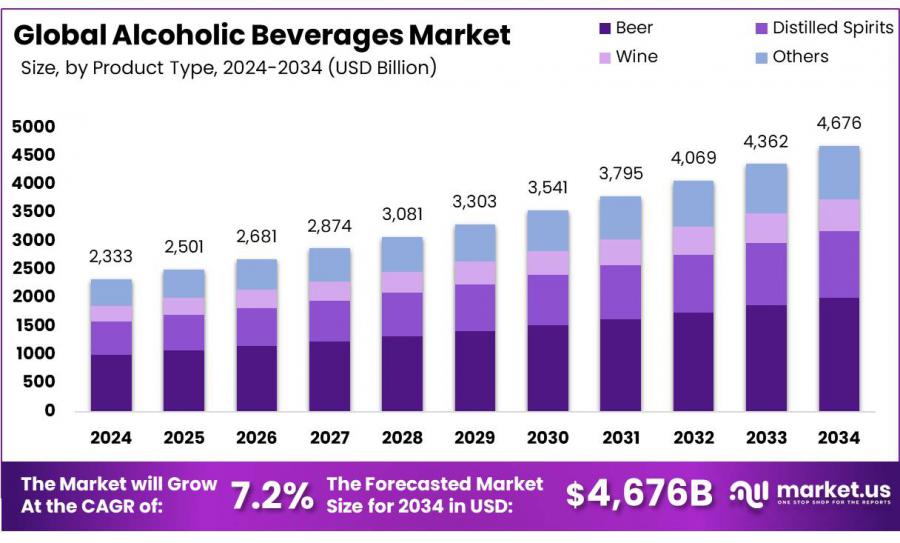

Alcoholic Beverages Market To Achieve USD 4676 Billion by 2034 | Expanding with a CAGR of 7.2%

Alcoholic Beverages Market is expected to be worth around USD 4676 Billion by 2034, up from USD 2332.9 Billion in 2024, at a CAGR of 7.2% from 2025 to 2034.

NEW YORK, NY, UNITED STATES, January 24, 2025 /EINPresswire.com/ -- Report Overview

The global Alcoholic Beverages Market is a dynamic and expansive industry that encompasses a wide range of products, including beer, wine, spirits, and ready-to-drink (RTD) cocktails. The market has witnessed substantial growth over the years, driven by evolving consumer preferences, increasing disposable incomes, and the rising influence of Western drinking culture in emerging economies. Alcoholic beverages have long been ingrained in social traditions and cultural practices, making them a key component of hospitality and entertainment sectors worldwide. The industry is highly competitive, with leading players focusing on product innovations, premiumization, and expansion into emerging markets to maintain their market position.

The market has also been significantly impacted by regulatory frameworks, including taxation policies, labeling requirements, and restrictions on advertising and distribution. The growing trend of online retail and e-commerce has transformed sales channels, providing consumers with greater accessibility to premium and international brands. Moreover, sustainability and responsible drinking initiatives have gained momentum, prompting manufacturers to adopt eco-friendly packaging and ethical sourcing practices.

Several driving factors contribute to the continued expansion of the alcoholic beverages market. One of the primary drivers is the shift in consumer preferences toward premium and craft beverages, as consumers increasingly seek unique flavors, authenticity, and high-quality ingredients. The rising popularity of experiential drinking, including cocktail culture and mixology, has also fueled demand for spirits and RTD beverages.

Additionally, the growing influence of millennials and Gen Z consumers, who prioritize social experiences and brand storytelling, has prompted companies to develop innovative marketing strategies. Urbanization and changing lifestyles have further accelerated market growth, particularly in developing regions where disposable incomes are rising, and alcohol consumption is becoming more socially acceptable. Furthermore, health-conscious consumers are driving the demand for low-alcohol and no-alcohol alternatives, leading to the expansion of non-alcoholic beer, wine, and spirits segments.

Looking ahead, the global alcoholic beverages market presents significant growth opportunities, particularly in emerging economies across Asia-Pacific, Latin America, and Africa. As disposable incomes increase and urbanization expands, these regions are expected to witness a surge in alcohol consumption, with international players investing heavily in local production and distribution networks. Innovation remains a key growth lever, with companies focusing on new product formulations, hybrid beverages, and sustainable production techniques.

The rise of direct-to-consumer sales, including subscription services and personalized drink offerings, is another emerging trend that is likely to reshape the market landscape. Additionally, technological advancements, such as artificial intelligence and blockchain in supply chain management, are expected to enhance efficiency and transparency across the industry. While regulatory challenges and concerns over alcohol consumption remain, the market is poised for steady expansion, with industry players leveraging strategic partnerships, mergers, and acquisitions to strengthen their foothold in the competitive landscape.

Curious about the content? Explore a sample copy of this report: https://market.us/report/alcoholic-beverages-market/free-sample/

Key Takeaways

• The Global Alcoholic Beverages Market is expected to be worth around USD 4676 Billion by 2034, up from USD 2332.9 Billion in 2024, and grow at a CAGR of 7.2% from 2025 to 2034.

• In 2024, the beer segment held a dominant market position within the alcoholic beverages market, capturing more than a 42.40% share.

• In 2024, the plain segment of the alcoholic beverages market held a dominant market position, capturing more than a 68.60% share.

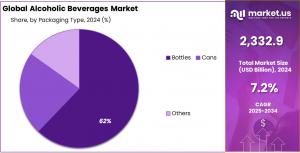

• In 2024, bottles held a dominant market position in the packaging types segment of the alcoholic beverages market, capturing more than a 62.40% share.

• In 2024, the 26-35 years age group held a dominant market position in the alcoholic beverages market, capturing more than a 32.20% share.

• In 2024, the off-trade channel held a dominant market position in the distribution of alcoholic beverages, capturing more than a 62.20% share.

• Regional Dominance – Asia Pacific (APAC): Asia Pacific secured a 46.9% revenue share in 2024, showcasing its pivotal role in the ACSR market’s growth.

Alcoholic Beverages Top Trends

• Rise of Non-Alcoholic and Low-Alcohol Beverages: There's a growing demand for non-alcoholic and low-alcohol drinks, driven by health-conscious consumers and the "sober curious" movement. Innovative products like non-alcoholic spirits, wines, and beers offer complex flavors, providing alternatives for those seeking moderation without compromising on taste.

• Premiumization and Craft Beverages: Consumers are increasingly willing to pay more for premium and craft alcoholic beverages. This trend reflects a desire for unique flavors, artisanal production methods, and high-quality ingredients, leading to a surge in craft breweries, distilleries, and wineries offering specialized products.

• Hard Seltzers and Flavored Malt Beverages: Hard seltzers have gained significant popularity due to their refreshing taste, low-calorie content, and variety of flavors. These carbonated alcoholic drinks appeal to health-conscious individuals seeking lighter alternatives to traditional beers and cocktails.

• E-commerce and Direct-to-Consumer Sales: The convenience of online shopping has extended to the alcoholic beverages sector, with a notable increase in e-commerce and direct-to-consumer sales. Consumers appreciate the ease of browsing diverse selections and having products delivered to their doorsteps, a trend accelerated by the global pandemic.

• Sustainable and Ethical Production: Environmental and social responsibility are becoming important factors for consumers. Brands that adopt sustainable practices, such as eco-friendly packaging, ethical sourcing of ingredients, and carbon-neutral production processes, are gaining favor in the market.

Buy The Complete Report to read the analyzed strategies Get Discounts of Up to 30%! https://market.us/purchase-report/?report_id=136776

Key Market Segments

By Product Type

In 2024, the beer segment maintained its dominance in the alcoholic beverages market, holding a 42.40% market share. This segment encompasses a variety of sub-types including ale, lager, and hybrid beers, each catering to different consumer tastes with distinctive flavors and brewing methods. The surge in craft beer popularity and the growth of microbreweries have played crucial roles in driving this segment's expansion, highlighting a consumer shift towards premiumization and diverse offerings.

By Category

The plain segment commanded the largest share of the alcoholic beverages market in 2024, accounting for 68.60%. This category primarily features traditional, unflavored beverages like beers, spirits, and wines, which remain popular due to their historical market presence and solid consumer base. The preference for these beverages is driven by consumers valuing authenticity and the heritage of traditional drinks.

By Packaging Type

Bottles were the preferred packaging type in the alcoholic beverages market in 2024, with a market share of 62.40%. Traditionally, bottles have been favored for their ability to preserve the flavor and quality of alcoholic drinks such as beer, wine, and spirits. Glass bottles, in particular, are chosen for their superior ability to maintain product integrity and provide a premium look.

By Age Group

Individuals aged 26-35 years dominated the alcoholic beverages market in 2024, holding a 32.20% share. This demographic, which includes young professionals and early family starters, often has disposable income and a social lifestyle that influences market trends, particularly toward premium and craft beverages that offer unique drinking experiences.

By Distribution Channel

The off-trade channel was predominant in the distribution of alcoholic beverages in 2024, with a market share of 62.20%. This channel includes supermarkets/hypermarkets, specialty stores, convenience stores, and online retailers, providing convenience for consumers buying drinks to enjoy at home. Supermarkets and hypermarkets are particularly significant within this channel, offering a broad selection of products at competitive prices.

Key Market Segments List

By Product Type

• Beer

—— Ale

—— Lager

—— Hybrid

• Distilled Spirits

—— Rum

—— Whiskey

—— Vodka

—— Others

• Wine

—— Sparkling Wine

—— Fortified Wine

—— Others

• Others

By Category

• Plain

• Flavored

By Packaging Type

• Bottles

• Cans

• Others

By Age Group

• 18-25 Years

• 26-35 Years

• 36-45 Years

• Above 46 Years

By Distribution Channel

• On-trade

—— Pubs, Bars & Cafe’s

—— Hotels & Restaurants

—— Others

• Off-trade

—— Supermarkets/Hypermarkets

—— Specialty Stores

—— Convenience Stores

—— Online Stores

Regional Analysis

North America led the global Alcoholic Beverages Market in 2024, holding a commanding 38.40% share, which translated to a market value of USD 895.8 billion. The U.S. plays a pivotal role in this region, catering to a diverse consumer base with a penchant for premium alcoholic products such as craft beers, fine wines, and artisanal spirits. The strong regulatory framework and established distribution networks in the region support the widespread availability and consumption of alcoholic beverages.

Regulations On the Alcoholic Beverages Market

• Legal Drinking Age: Many countries set a minimum legal drinking age to control alcohol consumption among young people. For instance, in the United States, the legal drinking age is 21, while in many European countries, it is 18. These laws aim to reduce underage drinking and its associated risks.

• Licensing Requirements: Establishments that manufacture, distribute, or sell alcoholic beverages typically must obtain specific licenses. These licenses regulate who can sell alcohol, the types of alcohol they can sell, and the hours during which sales are permitted. Failure to comply can result in fines or license revocation.

• Labeling and Advertising: Regulations often mandate that alcoholic beverage labels include information such as alcohol content, health warnings, and producer details. Advertising is also regulated to prevent targeting vulnerable populations, like minors, and to avoid misleading claims about the effects of alcohol.

• Taxation and Pricing: Governments impose excise taxes on alcoholic beverages, which can influence pricing. Higher taxes are often used as a public health measure to discourage excessive consumption. Some regions also implement minimum pricing laws to prevent the sale of very cheap alcohol.

• Restrictions on Sales and Consumption: Certain laws restrict where and when alcohol can be sold or consumed. For example, some areas prohibit public drinking or limit sales during specific hours or days. These measures aim to reduce alcohol-related incidents and promote public safety.

• Production Standards: Producers must adhere to specific standards regarding the production process, ingredient quality, and hygiene to ensure consumer safety. Regulatory bodies may conduct inspections and require compliance with established food and beverage safety standards.

Key Players

• Anheuser-Busch InBev SA/NV

• Heineken Holding NV

• Diageo

• Bacardi Limited

• Constellation Brands Inc.

• Pernod Ricard

• Radico Khaitan Ltd.

• Carlsberg Group

• Thai Beverage

• HiteJinro Co., Ltd.

• Molson Coors

• E & J Gallo Winery

• Beam Suntory

• Brown-Forman Corporation

• Campari Group

• Asahi Group Holdings, Ltd.

• The Wine Group

• Treasury Wine Estates

• Castel Group

• Accolade Wines

• Allied Blenders & Distillers

• Other Key Players

Conclusion

The global Alcoholic Beverages Market is navigating a period of significant transformation. While traditional segments like beer and wine maintain substantial market shares, there's a noticeable shift towards premiumization and craft offerings, reflecting consumers' evolving tastes. Simultaneously, the rise of non-alcoholic and low-alcohol alternatives indicates a growing health consciousness among consumers. Emerging markets, particularly in Asia-Pacific, present new growth opportunities, driven by increasing disposable incomes and urbanization.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Food & Beverage Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release