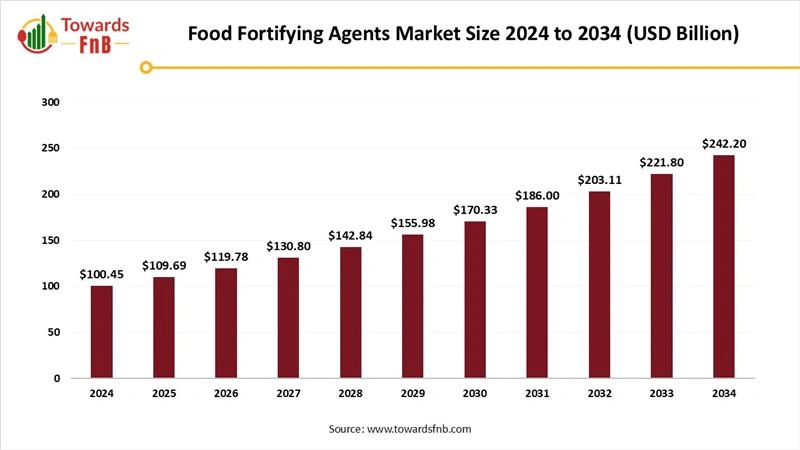

Food Fortifying Agents Market Size to Hit USD 242.2 Billion by 2034, Rising Consumer Awareness About the Importance of Nutrition

According to Towards FnB, the global food fortifying agents market size is predicted to increase from USD 109.69 billion in 2025 and is projected to hit around USD 242.20 billion by 2034, expanding at a CAGR of 9.20 % during the forecast period from 2025 to 2034.

/EIN News/ -- Ottawa, April 30, 2025 (GLOBE NEWSWIRE) -- The global food fortifying agents market size was accounted for USD 100.45 billion in 2024 and is projected to grow from USD 109.69 billion in 2025 to nearly USD 242.20 billion by 2034, registering a compound annual growth rate (CAGR) of 9.20% over the forecast period from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The growth of the food fortifying agents market is driven by growing consumer knowledge regarding the significance of nutrition, an increasing occurrence of micronutrient deficiencies, and a heightened demand for fortified food items. Furthermore, government programs supporting fortified foods, advancements in technology, and the emerging trend of personalized nutrition also contribute to the market's growth.

Explore All the Details in Our Solutions – Download the Brochure Now: https://www.towardsfnb.com/download-brochure/5531

Food Fortifying Agents Market Overview:

The market for food fortifying agents is consistently growing, propelled by heightened health awareness and a greater understanding of nutritional gaps among consumers. Agents such as vitamins, minerals, proteins, and probiotics are more frequently incorporated into common food and beverage products, enhancing their nutritional content. Innovation is prevalent as manufacturers seek new formulations to satisfy the demand for healthier, functional foods while preserving their taste and texture.

Key Highlights:

- North America led the market with a 32% share in 2024, driven by rising health awareness and food consumption.

- Asia Pacific is set to grow the fastest, fueled by increasing demand for nutritional foods.

- The vitamins segment held the largest share at 29% in 2024, driven by rising vitamin deficiencies and food fortification needs.

- Probiotics and prebiotics are expected to grow at a 10.5% CAGR, as consumers seek proactive health solutions.

- Dairy and dairy-based products held the largest share in 2024, as they are key in many diets and ideal for nutrient fortification.

- Fortified beverages accounted for 10% of the market, driven by growing consumer interest in nutrient-rich drinks.

Outstanding Product Innovations by the Top Market Companies

| Sr. No. | Name of the Company | Name of the Model | Name of the Brand | Usage |

| 1. |

DSM-Firmenich |

Fortitech® Premixes | DSM | Customized micronutrient blends for fortifying food and beverages |

| Life’s™ Omega | DSM | Plant-based omega-3 for functional food fortification | ||

| 2. |

BASF SE |

Newtrition® Iron Solutions | BASF | Iron fortification for staple foods like flour and cereals |

| Dry Vitamin A Palmitate | BASF | Fortification of oils, margarine, and dairy products | ||

| 3. |

Kerry Group |

BC30™ Probiotic |

Kerry |

Digestive and immune health fortification for functional foods |

| Wellmune® Beta-Glucan |

Kerry |

Immune-support ingredient in food, beverages, and supplements |

Government initiatives aimed at fortifying food to alleviate malnutrition have played a crucial role in fostering market development. The growing interest in preventive healthcare, combined with hectic lifestyles, is steering consumers toward fortified foods that provide added health advantages. Additionally, advancements in food science and technology have facilitated the seamless inclusion of these agents in a broad range of products. As consumer priorities shift toward wellness and immunity, the food fortifying agents market is anticipated to continue its robust upward trend worldwide.

Major Key Trends in Food Fortifying Agents Market:

- Increasing Demand for Functional Foods: Consumers are more frequently choosing foods that provide health benefits that extend beyond basic nutrition, such as enhanced immunity and digestion, which is driving the global demand for fortified and functional food products.

- Growth of Government Fortification Initiatives: Numerous governments are enforcing mandatory fortification programs to tackle micronutrient deficiencies, increasing the incorporation of food fortifying agents into essential foods like flour, milk, and salt.

-

Advancements in Fortification Technologies: New developments in encapsulation and nano-delivery technologies are allowing for more effective incorporation of vitamins and minerals into food products, enhancing nutrient stability, bioavailability, while preserving taste and texture.

Limitations & Challenges in Food Fortifying Agents Market:

- Complexity of Regulatory Compliance: Diverse fortification standards and labeling requirements in various countries create challenges for manufacturers striving to maintain consistent product formulations and secure international regulatory approvals.

- Elevated Cost of Fortified Foods: Fortified food products typically have higher production and retail expenses, which limits accessibility for lower-income consumers and may impede adoption rates in emerging and cost-sensitive markets.

-

Issues with Nutrient Stability and Shelf Life: Some nutrients lose potency during processing or storage, presenting difficulties in preserving their effectiveness over time and necessitating ongoing innovation in food formulation and packaging methods.

Opportunity In Food Fortifying Agents Market

The most significant opportunity within the food fortifying agents market lies in combating malnutrition and micronutrient deficiencies in developing areas through extensive fortification initiatives. With a rising population and limited access to varied diets, regions such as Africa and South Asia represent substantial potential for fortifying staple foods like rice, wheat flour, and milk. Additionally, increasing urbanization and government-supported health programs create a favorable environment for fortified packaged foods. Partnerships among global health organizations, government entities, and private sector food manufacturers can play a critical role in expanding fortification efforts and supplying essential nutrients to vulnerable populations in a sustainable and meaningful way.

- In March 2023, Dairy Farmers of America (DFA) introduced a probiotics-fortified, lactose-free UHT milk in partnership with Good Culture. This product marks the first of its kind in the U.S. market, merging the nutritional advantages of dairy with microbiome-enhancing probiotics while providing an economical alternative to kefir and kombucha.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Food Fortifying Agents Market Regional Analysis:

North America: Leader in Food Fortifying Agents Market

North America dominated the food fortifying agents market with the largest market share, fueled by heightened consumer awareness regarding nutritional health, strong regulatory support, and a significant demand for functional and fortified food items. The region benefits from extensive food enrichment initiatives, especially in the United States and Canada, where vital vitamins and minerals are frequently incorporated into staple foods such as cereals, dairy products, and baked goods.

Top North American Countries for Food Fortifying Agents Production

- United States: The United States is at the forefront in food fortifying agents due to its obligatory fortification laws, strong consumer interest in functional foods, and a well-established food processing sector that encourages health-oriented product innovation.

- Canada: Canada accounts for a substantial market share attributed to government-backed fortification initiatives, increasing consumer awareness of preventative health, and a growing prevalence of fortified cereals, dairy products, and beverages among various age groups.

-

Greenland: While the market is smaller in scale, Greenland is increasingly depending on imported fortified foods due to its limited agricultural production. A rising consciousness surrounding health is gradually boosting the demand for packaged foods enriched with essential nutrients.

A well-established food processing sector and active involvement from prominent nutraceutical and ingredient companies further strengthen market growth. Additionally, a rising interest in preventive health, demographic shifts toward an aging population, and trends in personalized nutrition contribute to the region’s sustained dominance in this market.

- In April 2024, Glanbia Nutritionals acquired Flavor Producers, a natural flavoring firm based in the U.S., for USD 300 million. This acquisition enhances its offerings in natural and organic flavor solutions, aligning with the growing need for clean-label and functional food components and positioning Glanbia to fortify its portfolio in the expanding food fortification arena.

Asia Pacific’s Significant growth in Food Fortifying Agents

Asia Pacific is the fastest growing market for the food fortifying agents market with a significant CAGR during the forecast period due to heightened health awareness, a burgeoning middle-class population, and an increased focus on addressing malnutrition. Nations like India and China are implementing extensive government-led food fortification programs aimed at key deficiencies such as iron, iodine, and vitamin A.

Major Factors for the Market’s Expansion in Asia Pacific:

- The growing occurrence of micronutrient deficiencies, particularly in countries like India and China, escalates the need for fortified foods and food fortifying agents to enhance public health and nutrition.

- The rapid expansion of the food and beverage sector in Asia Pacific amplifies the demand for food fortifying agents, as companies aim to boost the nutritional quality of their offerings to satisfy consumer preferences.

- Various governments in Asia Pacific are enacting regulations and initiatives that endorse food fortification, creating a favorable setting for the development of the food fortifying agents market.

The sector also benefits from rising urbanization and the growing demand for fortified packaged foods among health-conscious consumers. Moreover, collaborations between global nutrition organizations and local food producers are encouraging the uptake of nutrient-enriched offerings. This proactive emphasis on health is establishing Asia Pacific as a significant growth driver for the market.

- In April 2023, Royal DSM inaugurated a rice kernel fortification manufacturing facility in Hyderabad, India. The facility is designed to produce 3,600 tonnes of nutritionally enriched rice kernels each year. By utilizing hot extrusion technology, it combines vitamins and minerals with rice to combat micronutrient deficiencies in the region, while ensuring precise nutrient delivery and microbial safety.

Book a Meeting with Towards FnB and Boost Your Food and Beverage Business: https://www.towardsfnb.com/schedule-meeting

Food Fortifying Agents Market Report Scope

| Report Attribute | Key Statistics | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| CAGR | 9.20 | % |

| Market Size in 2024 | USD 100.45 Billion | |

| Market Size in 2025 | USD 109.69 Billion | |

| Market Size by 2034 | USD 242.20 Billion | |

| Dominated Region | North America | |

Food Fortifying Agents Market Segment Analysis

Type Analysis

The vitamins segment dominated the market with the largest market share due to their crucial importance in enhancing health, preventing deficiencies, and supporting overall wellness. With a growing awareness of vitamin shortages, especially in developing nations, producers are concentrating on enriching food items with vital vitamins such as D, B12, and A to satisfy the nutritional needs of consumers. This trend has markedly increased the demand for vitamin-based fortification agents in the market.

The prebiotics and probiotics segment is the fastest growing segment with a notable CAGR during the forecast period. As consumers become more health-aware and look for products that enhance gut health, the interest in prebiotics and probiotics is swiftly rising. These components, known for their ability to support digestive health and strengthen immunity, are being progressively incorporated into a variety of fortified food items, further propelling their market advancement.

Application Analysis

The dairy and dairy-derived products segment dominated the market with the largest market share, as they are ideal mediums for fortification. Dairy items such as milk, yogurt, and cheese are naturally abundant in vital nutrients, and enhancing them with extra vitamins and minerals boosts their nutritional value. With the surging demand for nutritious and functional foods, dairy remains a primary focus for the application of fortifying agents, addressing various health issues.

The beverages segment is the fastest growing segment with a significant CAGR during the forecast period, as health-conscious consumers are increasingly choosing fortified drinks. The rising popularity of functional beverages, including fortified juices, energy drinks, and plant-based options, can be attributed to their convenience and health advantages. As beverage producers aim to fulfill consumer expectations for additional nutrients, the use of fortifying agents is becoming more widespread, significantly contributing to growth in this area.

Browse More Research Reports:

- The global dairy food market size is expected to grow from USD 1,005.87 billion in 2025 to USD 1,728.48 billion by 2034, at a CAGR of 6.20% over the forecast period from 2025 to 2034.

- The global high-protein food market is poised for substantial growth over the next decade, with projections indicating significant revenue increases during the forecast period 2025-2034.

- The global superfoods market size is expected to grow from USD 201.17 billion in 2025 to USD 288.82 billion by 2034, at a CAGR of 4.10% during the forecast period from 2025 to 2034.

- The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.50% throughout the estimated timeframe from 2025 to 2034.

- The global probiotic food market size is expected to increase from USD 114.18 billion in 2025 to USD 377.2 billion by 2034, growing at a CAGR of 14.20% throughout the estimated timeframe from 2025 to 2034.

- The global ethnic food market size is forecasted to expand from USD 93.47 billion in 2025 to USD 179.21 billion by 2034, growing at a CAGR of 7.50% during the forecast period from 2025 to 2034.

- The global food additives market is forecast to grow from USD 128.14 billion in 2025 to USD 214.66 billion by 2034, driven by a CAGR of 5.90% during the forecast period from 2025 to 2034.

Food Fortifying Agents Top Companies

- Döhler GmbH

- Koninklijke DSM NV

- Chr. Hansen Holdings A/S

- BASF SE

- Kerry Group Plc.

- Arla Foods

- Cargill, Incorporated

- Nestle SA

- Tate & Lyle

- Du Pont De Nemours and Company

- Ingredion

- The Archer Daniels Midland Company

Recent Breakthroughs in Global Food Fortifying Agents Market:

- In April 2024, PLANTSTRONG, a brand specializing in plant-based foods, entered the plant-based milk sector, launching four varieties that are shelf-stable and enriched with essential nutrients like calcium, vitamin D, and vitamin B12. The company has responded to consumer concerns regarding additives and nutrient gaps in many plant-based items by meticulously formulating its milk.

- In January 2024, Evonik Industries launched VITAPUR, a new collection of water-soluble vitamins intended for food and beverage fortification in the Asia Pacific region. This product seeks to improve the nutritional quality of a wide range of food items, aligning with the growing demand for fortified foods in the area to tackle micronutrient deficits and enhance health outcomes.

Segments Covered in the Report

By Type

- Vitamins

- Minerals

- Proteins & Amino Acids

- Carbohydrates

- Prebiotics & Probiotics

- Lipids

- Others

By Application

- Dairy & Dairy-based Products

- Infant Formula

- Cereals & Cereal-based Products

- Beverages

- Dietary supplements

- Fats & oils

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5531

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-food-and-beverages

Distribution channels: Consumer Goods ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release